managing finances has become more convenient than ever. With the rise of mobile technology, financial management is no longer restricted to banks and financial advisors. How Finance Apps are revolutionizing the way individuals track their expenses, budget their income, and invest in their future.

How Finance Apps play a crucial role in helping users take control of their financial health. From automated savings to smart investment tracking, these apps provide the tools necessary to build wealth and achieve financial freedom. By leveraging technology, users can now make informed financial decisions without the hassle of traditional banking methods.

Understanding Financial Freedom

What is Financial Freedom?

Financial freedom means having enough savings, investments, and income streams to support your desired lifestyle. How Finance Apps contribute to financial freedom by helping users build better financial habits and manage their wealth more effectively. Achieving financial freedom requires discipline, proper planning, and consistent effort.

With the right tools, achieving financial freedom becomes more attainable. How Finance Apps offer features like budget tracking, investment insights, and automatic savings plans that help users stay on top of their financial goals. These apps simplify money management, making it easier to accumulate wealth over time.

The Role of Technology in Financial Management

Technology has significantly transformed financial management, making it more accessible to everyone. How Finance Apps allow users to automate their savings, set financial goals, and receive real-time insights on their spending habits. This ensures that users stay informed about their financial health at all times.

Moreover, digital finance tools remove the guesswork from money management. How Finance Apps offer AI-powered recommendations, helping users optimize their investments and reduce unnecessary expenses. With advanced algorithms, these apps guide individuals toward smarter financial decisions.

Benefits of Using Finance Apps

Expense Tracking and Budgeting

One of the biggest advantages of How Finance Apps is their ability to track expenses and manage budgets efficiently. Users can categorize their spending and set monthly limits to avoid overspending. This is essential for maintaining financial discipline.

By analyzing spending patterns, How Finance Apps help users identify areas where they can cut costs. This encourages mindful spending and ensures that individuals allocate their money wisely. Proper budgeting is a key component of financial freedom.

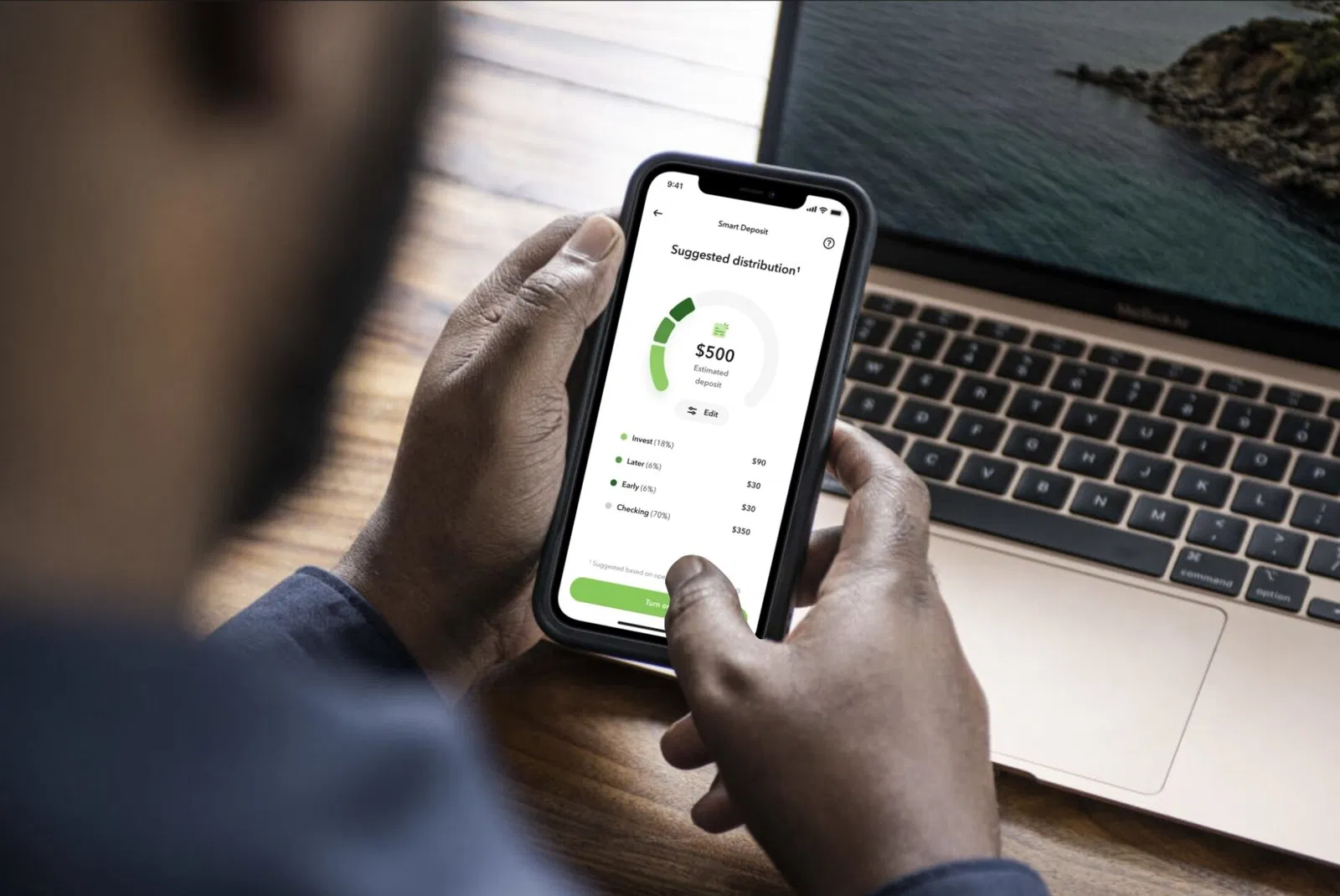

Automated Savings and Investments

Saving money consistently is crucial for achieving financial freedom. How Finance Apps offer automated savings features that allow users to set aside a percentage of their income without manual effort. These savings can be allocated toward emergency funds or investment opportunities.

Additionally, How Finance Apps provide investment tools that guide users in making profitable financial decisions. From stock investments to cryptocurrency tracking, these apps offer valuable insights that enhance wealth-building strategies.

Security and Reliability of Finance Apps

Data Protection and Privacy

Many people hesitate to use financial apps due to security concerns. However, How Finance Apps implement advanced encryption and security measures to protect users’ sensitive information. This ensures that financial data remains confidential and secure.

Users should opt for trusted finance apps with strong security protocols. How Finance Apps that use two-factor authentication and biometric verification add an extra layer of protection, safeguarding personal and financial data.

Reliable Financial Insights

Accurate financial insights are critical for making informed decisions. How Finance offer real-time analytics, helping users understand their financial status better. These insights allow individuals to track their net worth and make necessary adjustments to their financial plans.

With continuous updates and AI-driven recommendations, How Finance keep users informed about market trends and financial opportunities. This enhances their ability to achieve financial freedom through well-informed decisions.

Choosing the Right Finance App

Key Features to Look For

Not all finance apps are created equal. When selecting an app, users should prioritize features such as expense tracking, investment tools, and automated savings. How Finance that integrate multiple financial services provide greater convenience and efficiency.

Additionally, users should consider apps that offer personalized recommendations. How Finance with AI-powered insights help users make strategic financial decisions tailored to their goals. A well-rounded finance app should simplify rather than complicate financial management.

User Experience and Accessibility

A finance app should be user-friendly and accessible on multiple devices. How Finance with intuitive interfaces make financial management effortless. Users should opt for apps that provide seamless navigation and clear financial reports.

Furthermore, accessibility features such as cloud synchronization ensure that users can track their finances across different platforms. How Finance Apps that offer mobile and desktop compatibility enhance convenience and flexibility.

Conclusion

Achieving financial freedom requires discipline, planning, and the right tools. How Finance simplify financial management by offering expense tracking, automated savings, and investment insights. By leveraging these apps, individuals can take control of their financial future and work toward lasting financial independence.

With a variety of finance apps available, choosing the right one is crucial. How Finance with robust security, real-time analytics, and AI-powered recommendations provide the best support for financial success. Start using finance today and take a step closer to financial freedom.